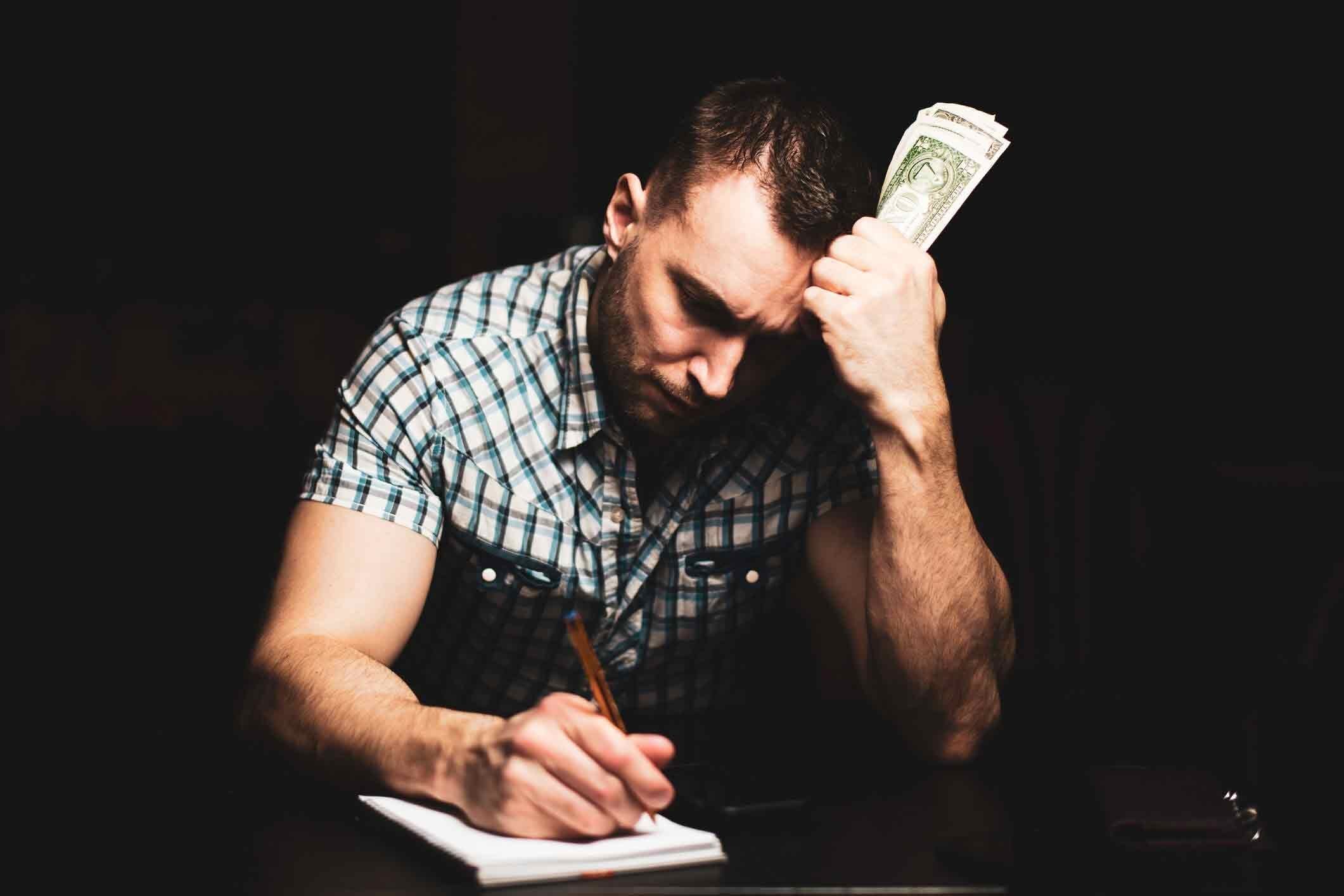

Terry Savage: Marriage and Money

The spring wedding season is upon us, and around the country brides, grooms and their parents are making arrangements for extravagant celebrations now that the COVID-19 pandemic is (hopefully) behind us.

Read This Article